Firms take part in the Cost of Time Survey for various reasons. However, the most important, at least for some, is that it helps them to make more money. The result is that firms take part on a regular basis. Two thirds of the 2012 participants took part in 2011 as well, and half have contributed in each of the last three years. They participate year after year because it is a great tool for benchmarking your firm with others and identifying where you are doing well and where you are performing poorly. It is of course confidential – the Law Society of Scotland does not see any of the information individual firms provide – and there is no charge.

The survey also gets good participation levels, especially amongst smaller firms, and the survey remains the largest annual survey undertaken by any law society in the UK. It is, as far as we are aware, the largest undertaken by any bar association in Europe.

In 2011 profit per partner improved slightly, and we had thought we had seen the worst of the recession. However in 2012 profitability slipped back again to just £64,000 per equity partner, as illustrated in chart 1.

The profitability of 10+ partner firms is based on a smaller sample and fluctuates fairly widely; however the chart indicates clearly the change that occurred in 2008.

Less valued?

For some, an income of £64,000 will sound high, but it does not compare especially well with other professions. GPs and dentists have traditionally been considered comparable professions, with similar training periods and levels of responsibility:

- a report by the Information Centre for Health & Social Care, GP Earnings and Expenses 2010-11 (September 2012) indicated that average net profit for GPs in Scotland for 2010-11 was £89,300

- a second report by the same body, Dental Earnings and Expenses, Scotland, 2009-10 indicated that average earnings for principal dentists (owners, directors or partners of a practice) in Scotland in 2009-10 were £113,800.

Partners in firms that undertake legal aid could make a strong argument that there are similarities between themselves, GPs and dentists – all are essentially paid by the Government – yet their incomes were very different. GPs and dentists also of course have the benefit of an NHS final salary pension scheme, something that equity partners have to provide themselves.

They all own and run businesses and bear risks greater than that of someone who is employed and paid through PAYE. A partner’s income comprises:

- a salary for their day job of working and managing the firm;

- interest for capital invested in it – and the average in this year’s survey was £58,000;

- rent if the offices are owned by the partners, as they often are;

- a reward for the risk of running their business.

Many partners will have entered into leases and some will have given personal guarantees. They all have their houses on the line if the business fails – something an employee does not have. With the median salary of a salaried (employed) partner standing at £48,000, and with a quarter earning more than £61,000, one might ask why become equity partners?

The answer of course is that some partners in some firms earn much higher profits. A quarter of sole principals earned more than £95,000, and a quarter of 10+ partner firms earned over £190,000, as illustrated in chart 2.

Profit plan

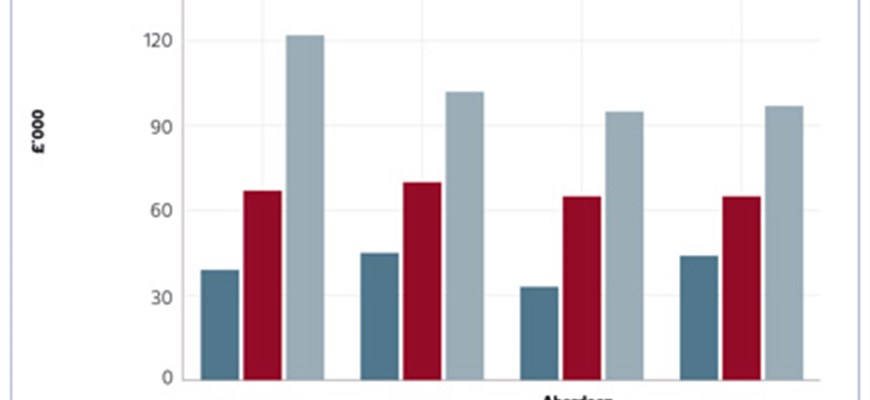

Clearly, for commercial work, being based in a major city is important. For smaller firms, however, it is less important. Chart 3 illustrates that some firms across the country were earning profits on a par with GPs and dentists.

These more successful firms are unlikely to be doing well simply because they were working hard personally. They are more likely to be earning good profits due to factors such as:

- the work they were doing was perceived as being work they could charge higher fees for;

- the way they were doing the work: they were more likely to be making effective use of technology, in particular digital dictation and voice recognition;

- they had good financial structures: there were a number of non-equity fee earners working with each equity partner;

- they were probably larger, because scale brings better teamworking, and an ability to support professionals in areas such as marketing, HR and IT.

They will also have had a plan, and good communications within their firm.

A good starting point for any firm that wishes to improve profitability is to download from the Society’s website a free copy of From Recession to Upturn, written by Andrew Otterburn and Fiona Westwood. It includes guidance on developing a plan and improving profitability.

Taking part: the benefits

This article is based on "The 2012 Survey of Law Firms in Scotland", published in February. The survey is an extremely useful management tool and this year a copy is being sent to every firm in Scotland. Participants also receive a free confidential individual report.

In April, the President will be writing to all firms inviting them to participate in the 2013 survey. Participation is free and carries a three-hour CPD credit as well as an individual report on cost rates in the firm and a copy of the survey report.

In recent years there has also been a prize draw. In 2012, the £700 prize was won by Gavin Bain of Gavin Bain & Co, Aberdeen. The Society is again grateful to Alex Quinn & Partners for sponsoring the prize in 2012.

In this issue

- Remember, remember?

- Equal justice for all?

- Compatibility: devolution issues reborn

- Profiting from the past

- RTI for PAYE - are you ready?

- Reading for pleasure

- A modest proposal – civil marriage ceremonies for all

- Opinion column: Alistair Dean

- Book reviews

- Profile

- President's column

- Fee review: as you were

- Time to draw a line?

- The pay gap: seeking a cure

- Wealth management: Personal injury trusts - how to best invest

- Wealth management: Discretion - the model of choice

- Wealth management: Inheritance tax - discounts up front

- Wealth management: Pensions - time to look ahead

- Whose privilege is it, anyway?

- FLAGS unfurled

- Percentage game

- Rent, rent and rent again

- Sport, rights, and the internet

- An innocent mistake?

- Scottish Solicitors' Discipline Tribunal

- The trouble with in-house lawyers

- Lease of life for the High Street?

- PSG update

- Vacant and ready

- ABS in waiting

- Better ways: where to start?

- Keeping errors in check

- Ask Ash

- How not to win business: a guide for professionals

- What does a speculative fee allow?

- Law reform roundup