We've reported a deficit of income over expenditure (prior to the actuarial charge to the Society's closed final salary pension scheme) of £119,000 for the financial year ended 31 October 2017 (2016 - £33,000 surplus). The actuarial surplus in respect of the scheme was £805,000 (2016 – £1,495,000 charge), giving a total recognised surplus for the year of £686,000 (2016 – recognised deficit of £1,462,000).

Income

The Group’s income in the year amounted to £11.50 million, an increase of 5.1% from last year. Income sources were as follows:

| Membership | 63% |

| Other Core Income | 16% |

| Other Fee Categories | 7% |

| Commercial | 9% | Other Income | 5% |

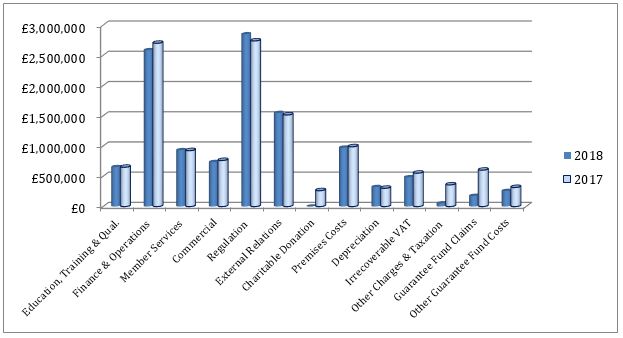

Expenditure

The Group’s expenditure (excluding actuarial charge to the closed pension scheme) was £11.62 million, an increase of 6.1% from last year. Expenditure was split as follows:

| Regulation | 24% |

| Finance & Operations | 22% |

| Member Services | 15% |

| External Relations | 12% |

| Education, Training & Qualifications | 6% |

| Other Operational Charges | 18% |

| Charitable Donation | 2% | Corporation Tax | 1% |

The Society’s investment portfolio performed strongly, showing unrealised gains of £252,000 and realised gains of £25,000.

The Society’s wholly-owned subsidiary company, Law Society of Scotland (Services) Limited, undertakes certain commercial opportunities on behalf of the Law Society of Scotland. It holds an investment in Altis Legal Limited, and also had a shareholding in Legal Post (Scotland) Limited which was sold during the year. Within the group accounts a provision has been made to reduce the valuation of Altis Legal Limited. In its first full year of operation Altis failed to meet its sales volume targets; as a consequence a provision of £58,000 has been made, calculated with reference to both anticipated sales over the next three years and current asset values, leaving a remaining value of £23,000.

Following a takeover, the shareholding in Legal Post (Scotland) Limited was sold. The Council determined that proceeds from the final distribution from Legal Post (£261,585) were donated to the Law Society of Scotland Educational Foundation, a charity registered in Scotland.

Cash balances at the year-end were £11.29 million, an increase of £559,000 from 2016. The principal factors were the receipt of the final instalment from the premises sale (£1.25m) and a reduction in creditors of £314,000. Subscription income received in advance of 1 November 2017 was £7.10 million.

The Society is responsible for a defined benefit pension scheme which was closed to future accrual from 1 May 2010. The most recent full actuarial valuation was carried out at 31 March 2016 by a qualified actuary, independent of the scheme's sponsoring employer. The next triennial valuation date is 31 March 2019.

The overall deficit shown by this valuation was £1,722,000 with the value of assets covering 78% of the value of the liabilities. A deficit recovery repayment plan has been agreed with the scheme trustees which has resulted in a contribution of £219,000 on 31 March 2017, and £170,000 per annum thereafter. The Society will also pay £1,000,000 to the Scheme by 31 March 2018. These contributions are designed to remove the deficit by 31 March 2021. The liability is reflected in these accounts using Financial Reporting Standard 102, which involves less prudent assumptions than those applied in the triennial actuarial valuation as explained in note 19.

At 31 October 2017 there was a scheme deficit for financial reporting purposes of £277,000. This compares to a deficit of £1,267,000 at the previous review date. This change is mainly due to higher than expected returns on the Scheme’s assets, changes in demographic assumptions in line with the most recent actuarial valuation and the annual employer contributions paid into the Scheme. This has been partially offset by a fall in corporate bond yields which increased the value of the liabilities as at 31 October 2017.

The Society’s reserves policy is to hold between three and six months’ average expenditure. Reserves for this purpose are defined as net current assets plus realisable investments, less pension scheme deficit (from the most recent valuation less recovery plan payments made subsequently).

At 31 October 2017 this figure amounted to £4.94 million, which is between four and five months’ average expenditure. The committee regards this level as satisfactory. In monitoring reserves the committee recognises the remaining operating lease commitment for the rent of the Society’s premises (note 27).

The Society’s annual report includes the president's introduction, chief executive's overview of the year, sections measuring progress made against the corporate plan, a report on governance arrangements, the accounts of the Guarantee Fund and a summary of work on equality and diversity. It is available on the Society’s website.

The Society remains committed to achieving continual improvement in its financial performance through:

- achieving efficiencies and cost savings across the business

- improved financial forecasting

- growth of non-subscription incomes

- maintenance of reserves at an appropriate level

- managing historic final salary pension scheme liabilities through close liaison with the scheme’s trustees

The Society carries out ongoing monitoring and management of the risks it faces. Risks are also considered for each activity within the Society’s strategic objectives and annual plan. The risk register is reviewed monthly by the Society’s executive team and subject to additional scrutiny by the Audit Committee, Board and internal auditors. Key risks include:

- the independent review of the regulation of legal services established by the Scottish Government, the purpose of which is to make independent recommendations to reform and modernise the framework for the regulation of legal services and complaints handling.

- the remaining liability on the closed final salary pension scheme and exposure to market risk

- GDPR, which provides both commercial and compliance risks

- failure to deliver the Society’s strategic objectives

The effectiveness of controls to mitigate every risk on the risk register is continually monitored by the senior leadership team and reported to Audit Committee and Board quarterly.

The budget approved by the Council for 2016/17 left the cost of the practising certificate unchanged at £550. The retention fee and non-practising member fee also remained unchanged at £100 and £200 respectively.

The Society is the professional body and regulator of Scottish solicitors. It has responsibility for promoting the interests of the solicitors’ profession in Scotland and the interests of the public in relation to the profession. The Society’s responsibilities as a professional body and regulator are overseen by both its Council and its Regulatory Committee. The Council consists of up to 48 seats, of which 31 are elected solicitor members, up to nine lay members eight co-opted solicitor members, and such ex officiis members as may be required.

The Society is a statutory body governed by the Solicitors (Scotland) Act 1980 with a Constitution made under that Act and accompanying standing orders. The Society is committed to the principles of good corporate governance.

The Society’s governing body is the Council which sets the overall strategy as well as the annual corporate plan and associated budget. The Council has put in place an ambitious five year strategy entitled “Leading Legal Excellence” which is due to be delivered by 2020 The Council manages the overall strategic direction for the Society within the context of the annual corporate plan and annual budget. The Council also measures the Society’s performance against the annual corporate plan within the context of the Society’s longer term goals set out in the new five year strategy. The Council delegates the monthly oversight of the Society’s implementation of the plan to the Board. The Board is chaired by the Society’s President and is made up of the Vice President, Past President, Treasurer and five other elected Council members. Sitting beneath the Board is the Chief Executive, the senior leadership team and management team, who all work together to implement the annual corporate plan, deliver the five year strategy as well as managing the Society on an operational basis.

There are a number of checks and balances within the Society’s governance model which seek to ensure an appropriate and fair discharge of the Society’s statutory responsibilities as a professional body. These checks and balances include the monthly reporting of progress on the implementation of the annual corporate plan to the Board and the Council. The oversight of the regulatory duties of the Council is discharged by the Regulatory Committee through a delegated authority scheme in conjunction with the various Regulatory sub-committees and the Society’s employees.

The Society’s Audit Committee has, as one of its main roles, responsibility for reviewing and making recommendations with respect to the Society’s internal control and risk management system in order to monitor and assess the effectiveness of those procedures and management and reporting systems. The Convener of the Audit Committee reports quarterly to the Council on these matters as well as annually to the members at the annual general meeting. The Audit Committee benefits from the provision of internal audit services provided by Wylie & Bisset CA.

The Society also has a Finance Committee chaired by a Council member who is the Society’s Treasurer. The Finance Committee has responsibility for producing and then presenting the annual budget for approval to the Council and thereafter to the special general meeting in September. There is also a Nominations Committee chaired by a Council member, which oversees the system for the appointment of members to the Society’s committees as well as making recommendations for the appointment of the Conveners for such committees.

There is a short life Governance Working Party chaired by Council member George MacWilliam which is looking at making improvements to the operation of all representative committees.. The new Public Policy Committee has completed its first year of operation This new committee has replaced the former Law Reform Committee which has been stood down. The principal role of this new committee is to oversee all the public policy work of the Society and to ensure that it is in line with the Society’s five year strategy.

The Society has three Office Bearers: the President (who is the Chairman of the Society), the Vice President and the Past President. Each of these three Office Bearers take office for one year. The Vice President becomes President with the handover taking place at the Council meeting in May. The Office Bearers together with the Chief Executive are the Society’s main ambassadors and represent the Society at home and abroad.

The Chief Executive’s key responsibilities include the provision of leadership and the vision necessary to create a professional body which effectively regulates and represents the interests of its members and delivers a range of services and products as required by the profession. The Chief Executive is responsible for advising the Council and the Board on the development and implementation of policy as well as managing the Society’s staff and resources. The Chief Executive works alongside the Office Bearers and Council in providing effective and meaningful communications and representing the Society. Additionally the Chief Executive is responsible for ensuring effective relationships with members, external bodies (including governments) at the highest level and internationally, and with all other appropriate third parties, the public and the media. The Chief Executive is also responsible for ensuring that the respective parts of the Society’s governance structure operate effectively and efficiently.

The Council’s responsibilities are set out in statute, the constitution and the standing orders. The principal role of the Council is to approve the strategy, annual corporate plan and the annual budget for the Society. The Council also sets the most significant fees for members as well as recommending the practising certificate subscription for members to consider at the autumn special general meeting. There is also a Code of Conduct which sets out the standards of behaviour for Council members. The Chair of the Council is the President.Greater details of the Society’s governance arrangements are available on the Society’s website.

The principal roles of the Board are:

- to provide guidance to the Society’s executive on initial drafts of strategy and the annual corporate plan which will include resource plans before their submission to the Council for approval

- to provide direction to both the executive and committees on any strategic level initiative or project before submission to Council for approval

- to monitor the quarterly performance of the Society against its targets contained in the annual corporate plan and report any major variance to Council

- to regularly monitor the Society’s financial performance against budget and to ensure that all risks identified in the Society’s risk register are managed and escalated to Council for those which the Board consider to have the potential to have a high impact on the work of the Society, and with a medium to high likelihood of occurring

The principal roles of the Regulatory Committee are:

- to ensure that the standards for the profession are set by way of making relevant and appropriate rules, to be applied in a uniform and consistent way and regularly reviewed

- to ensure that the internal processes, policies and procedures adopted by the regulatory sub-committees are effective, appropriate and proportionate in order to ensure the making of consistent regulatory decisions and to build and develop relations with appropriate third parties to ensure confidence in the work of the profession and the Society’s regulatory regime